The Narendra Modi government in India is taking nessecary steps to make digital techology a core strategy to deliver happiness to it's citizen. We covered FASTag RFID Automated Toll Collection system earlier, and today we will write about the "Unified Payments Interface (UPI)" - a system which is slowly taking shape to change the landscape of how people make financial transaction in India.

The Narendra Modi government in India is taking nessecary steps to make digital techology a core strategy to deliver happiness to it's citizen. We covered FASTag RFID Automated Toll Collection system earlier, and today we will write about the "Unified Payments Interface (UPI)" - a system which is slowly taking shape to change the landscape of how people make financial transaction in India.

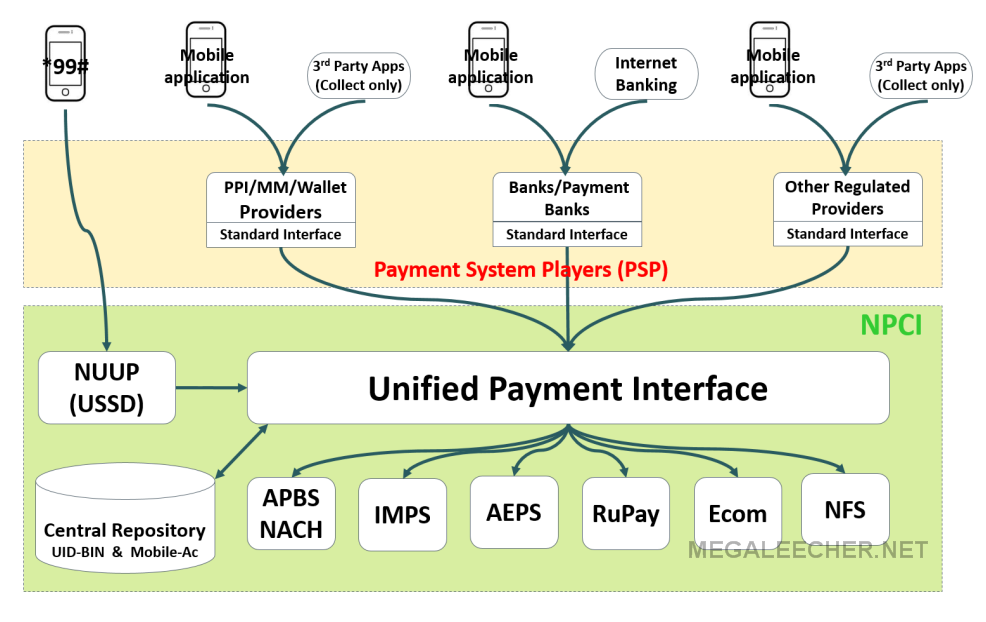

The online industry has been booming at a rapid pace in the recent times, so much so that most of top brands in Fortune 500 list are online brands. From social media platforms to online shopping websites, there is no dearth of online players in the industry. However, the one thing that is universal across all online platforms is online payment system. Today, every website accepts Paypal, Bitcoin, Credit/Debit Card and Netbanking. However, there is no denying the fact that it is a hassle to enter all your details every time you have to make a payment online. While all websites offer saving these details for easy future payments, however, they are not considered safe and are at the risk of getting stolen. To address this issue, Reserve Bank of India launched a new smartphone based service called Unified Payments Interface (UPI) in the country. UPI is being touted as the future of online banking and here is why?

What is UPI?

You can think of UPI as the advanced version of the existing Immediate Payment Service (IMPS). Some people are also calling it a virtual debit card as it does all the functions of a debit card or netbanking. However, UPI happens to be safer and more secure alternative. If you opt to make payment through the UPI method, the transfer of money takes place without using any conventional method of payment. All it takes is an app on your smartphone and support of the banks in transaction. 29 banks have already agreed to provide UPI service and as many as 21 banks have already registered as payment service providers under UPI. This is a good initiative as it only takes a couple of click and payment would be directly transferred from your bank account to the merchant's bank account.

The

The